Listen to the article

The Bitcoin options market has quietly become one of the most revealing arenas for gauging trader sentiment. And right now, it’s flashing mixed but telling signals. While Bitcoin has clawed its way back from the early-October washout that vaporized tens of billions in leveraged bets, the options data suggests investors are still hedging their excitement with caution.

Term structure flattens after the shakeout

The backdrop for all this is a market that’s still digesting one of the sharpest deleveraging events in crypto history. October’s collapse wiped out over 19 billion dollars of leveraged positions, leaving futures open interest at its lowest in months before slowly rebuilding as traders repositioned. Glassnode’s latest Options Weekly shows that open interest has reset and is now rising again into Q4. That’s what they call a “cleaner” market structure, free from expiry-driven noise.

Yet the volatility term structure, essentially how traders price risk across time, has steepened again at the short end. Short-dated implied volatility remains elevated, hovering near 50%. That’s traders paying up for near-term insurance, signaling wariness about further shocks rather than faith in a smooth rebound.

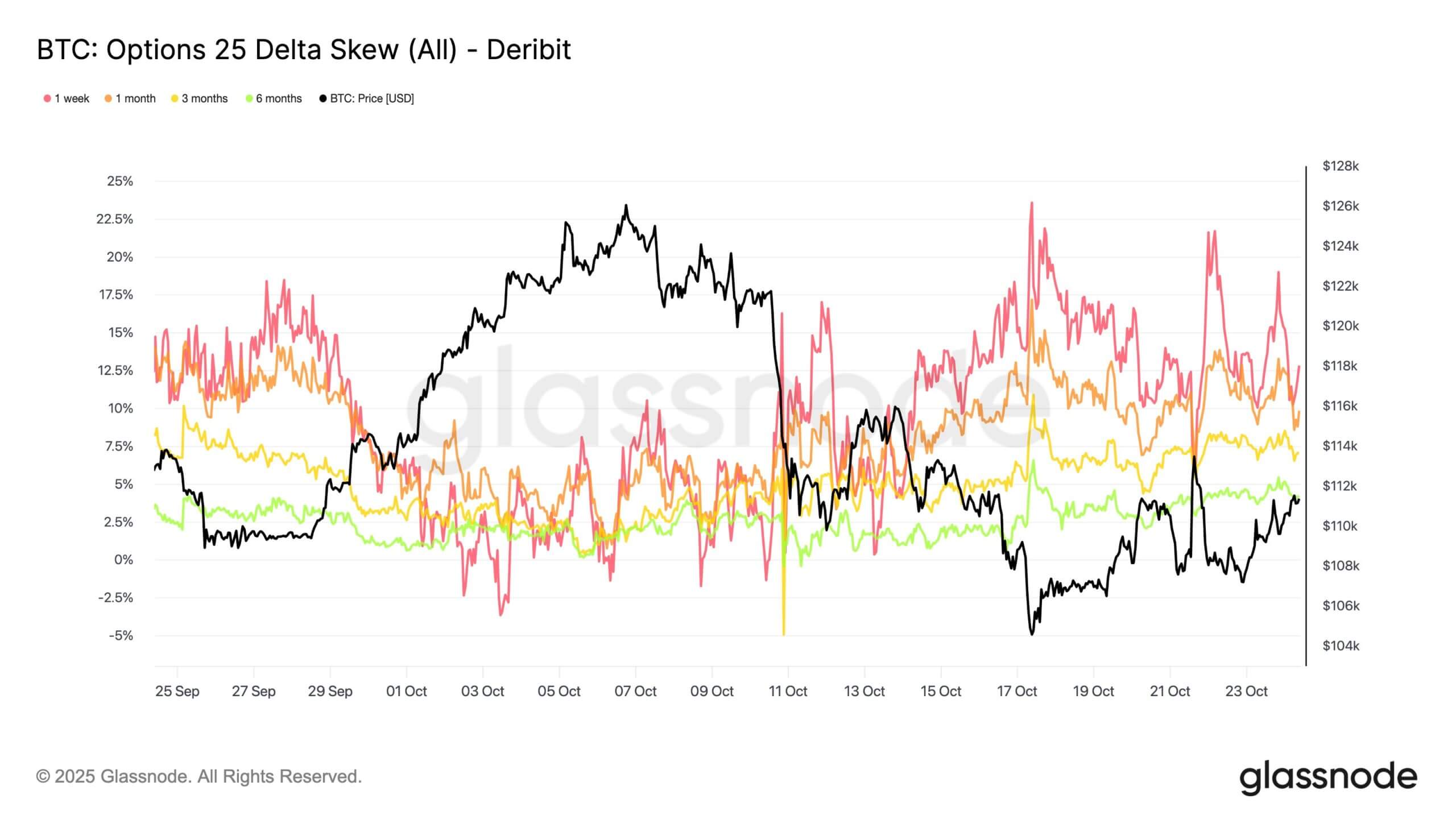

Skew shows downside bias

Skew is an indicator measuring whether traders favor upside calls or downside puts. It echoes the same story. Glassnode points to persistent demand for puts, with the 25-delta skew several vol points higher toward downside protection, even after Bitcoin’s brief bounce to around $120,000. Institutions, Glassnode notes, have been layering in these hedges while taking profits into strength, which is a sign of “defensive positioning” rather than capitulation.

In other words, the market isn’t screaming risk-off, but the appetite for upside is cautious. Traders are paying attention to macro catalysts and keeping protection in place. That’s a stark contrast to early 2025, when short-volatility strategies dominated.

The carry trade dies down

The once-lucrative volatility carry trade (shorting options to earn premium as realized volatility stayed dormant) has effectively vanished. With realized and implied vol now converging, that easy income has disappeared, leaving traders to actively manage exposure rather than simply collect yield.

October’s volatility, triggered by President Trump’s renewed tariff threats against China, jolted implied volatility from 40% to over 60%. While it’s cooled slightly, it remains well above pre-crash levels. That stickiness in implied vol suggests traders remain unsettled about liquidity and autoredeleveraging risk.

Defensive flows dominate Bitcoin options

Recent option flows confirm that the market’s bias is still on the defensive. Roughly $31 billion in Bitcoin options are set to expire over Halloween week, which is one of the largest expiries on record. What’s telling is how these contracts are structured. Heavy put concentration around the $100,000 strike and calls clustered near $120,000, almost perfectly bracketing Bitcoin’s recent range. Dealers are short gamma on the downside and long on the upside, a setup that tends to suppress rallies and intensify selloffs.

Bloomberg’s early-October reporting described traders piling into $140,000 calls during Bitcoin’s euphoric move above $126,000. But as the rally faded, that bullish momentum gave way to hedging and profit-taking.

Waiting for CPI

For now, the next major volatility reset hinges on macro data. Traders are holding off until the upcoming U.S. CPI report after the government shutdown backlog clears, which will likely shape cross-asset volatility pricing. Glassnode analysts note that with this compressed setup, elevated front-end volatility, defensive skew, and a fading carry, any macro jolt could quickly swing the market back toward directional extremes.

In short? The Bitcoin options market is showing less euphoria, more wisdom. Traders have learned from October’s shock and are balancing the optimism of “Uptober” with an unusually sober approach to risk. Volatility isn’t going away, it’s just being managed better.